Importance of diversifying investment portfolio

Diversifying your investment portfolio is crucial as it spreads risk across various assets, reducing potential losses. This strategy ensures more stable returns and cushions against market volatility, ultimately safeguarding your financial well-being and growth.

Introductory explanation of why Singapore is an interesting place to invest in silver

Singapore is an intriguing destination for silver investment due to its robust financial infrastructure, favorable tax policies, and strategic location as a global trading hub. The city-state’s reputation for political stability and economic resilience further enhances its appeal to investors seeking to diversify their portfolios with precious metals. Additionally, Singapore’s stringent regulatory environment ensures transparency and security in transactions, making it a trustworthy market for buying and storing silver. With easy access to world-class storage facilities and a thriving marketplace, investors can confidently buy silver bullion singapore has, benefiting from competitive pricing and efficient trading processes. This combination of factors makes Singapore a compelling choice for those looking to capitalize on the growing demand for silver and secure their investments in a stable and prosperous environment.

What Silver Bullion is and its Types

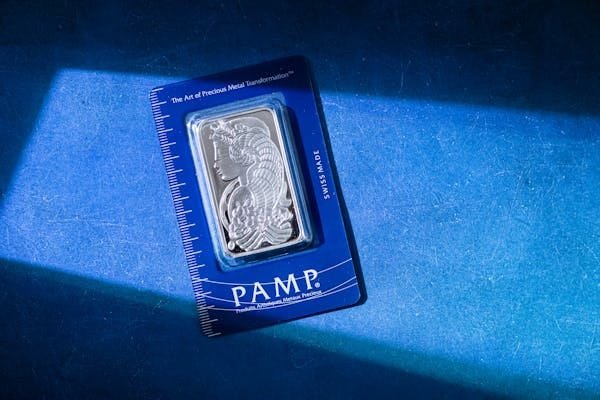

Definition of silver bullion

Silver bullion refers to pure or nearly pure silver that’s been processed into bars, ingots, or coins for investment purposes. Its value is based on its weight and purity rather than face value or design.

Why Invest in Silver Bullion

Overview of benefits of investing in silver bullion

Investing in silver bullion offers benefits such as portfolio diversification, inflation hedging, and asset preservation. Its tangible nature provides stability amidst market volatility, while its industrial demand supports long-term value growth.

Comparison of Silver Bullion to other types of investments (Gold, Stocks)

Silver bullion, unlike gold and stocks, offers a distinct hedge against economic downturns. While gold boasts enduring value, stocks promise higher returns but risk volatility. In contrast, silver balances affordability with reliable security for investors.

Explanation of how silver bullion can act as a hedge against inflation

Silver bullion serves as a hedge against inflation by preserving purchasing power during economic downturns. Its consistent intrinsic value often rises when fiat currencies depreciate, protecting investors from the loss of money’s real worth.

The Silver Market in Singapore

Profile of the Singapore silver market

Singapore’s silver market thrives with robust trading, supported by sophisticated infrastructure and strategic geographic positioning. Recognized for its security and regulatory standards, it attracts global investors looking to diversify portfolios with precious metal assets.

Analysis of the growth of silver investment in Singapore

The study explores the expanding interest in silver investments within Singapore, noting increased market participation and financial strategies driving this trend. Factors like economic resilience and investor diversification contribute to growing appeal towards precious metals.

Factors attracting investors to Singapore’s silver market

Investors are drawn to Singapore’s silver market due to its stable economic environment, advanced financial infrastructure, favorable regulations, and a strategic location serving as a gateway for trade between the East and West.

How to Buy Silver Bullion in Singapore

Step-by-step guide on how to start investing in silver bullion in Singapore

Learn how to invest in silver bullion in Singapore with this simple guide. It covers essential steps from understanding market trends, choosing reliable dealers, purchasing securely, and storing your investment for optimal safety and value growth.

Essential tips for silver bullion investing

Investing in silver bullion requires careful consideration, including assessing market trends, understanding storage options, verifying authenticity, and evaluating dealer reputation. Diversifying investments can also mitigate risks while leveraging the metal’s potential for currency instability hedging.

Overview of reputable silver bullion dealers in Singapore

Reputable silver bullion dealers in Singapore offer a variety of investment-grade products, ensuring authenticity and competitive pricing. Key players include BullionStar and Silver Bullion Pte Ltd, renowned for their transparency, customer service, and industry expertise.

Affordability of Silver Bullion Investment in Singapore

Summary of costs associated with buying and storing silver bullion in Singapore

Purchasing and storing silver bullion in Singapore involves initial costs like market price premiums, dealer fees, taxes, and secure storage expenses including vaulting services, insurance charges for protection against theft or loss, and potential transportation fees.

Examination of the competitive prices in the Singapore market

Analyzing competitive pricing within Singapore’s market reveals significant variations, influencing consumer choices and business strategies. This examination highlights these price differences, emphasizing the importance for companies to adopt competitive pricing tactics.

Mention of investment options for different budget ranges

Offering various investment options caters to diverse budget ranges, ensuring everyone can participate. Low-budget choices include ETFs and micro-investing apps, mid-level budgets might consider mutual funds, while high-budgets could explore real estate or individual stocks.

The Future of Silver Bullion Investment in Singapore

Overview of the increasing demand for silver bullion in the global market

The global market is experiencing a surge in demand for silver bullion, driven by its industrial applications and investment appeal. As economic uncertainties rise, more investors are turning to silver as a safe haven asset.

Predictions for the future of Singapore’s silver market

Analysts forecast that Singapore’s silver market will experience substantial growth due to increasing industrial demand and investment interest, driven by technological advancements, enhanced trading platforms, and the city-state’s strategic positioning as a financial hub.

Encouragement to invest in silver bullion in Singapore

Investing in silver bullion in Singapore offers potential financial growth and portfolio diversification. With a robust market and secure storage options, it is a smart choice for those looking to enhance their investment strategy.